Introduction

How to invest $100 in 2025 is one of the most common questions beginners ask when they want to start building wealth but feel limited by a small budget. Many people believe investing requires thousands of dollars, expert knowledge, or high risk, but that’s no longer true. Thanks to modern investment platforms, fractional shares, ETFs, and low-cost tools, you can begin investing with just $100 and still create meaningful long-term growth.

In today’s digital economy, investing small amounts has become easier, safer, and more accessible than ever before. You don’t need to wait until you earn more money or reach a perfect financial situation. Starting with $100 allows you to learn the fundamentals of investing, understand how markets work, and develop strong financial habits without overwhelming risk. In fact, many successful investors began with small amounts and gradually increased their investments over time.

Learning how to invest $100 in 2025 is especially important because inflation continues to reduce the value of idle cash. Money sitting in a regular savings account often loses purchasing power, while smart investments can help your money grow. Even a modest investment, when combined with consistency and patience, can compound into significant wealth over the years.

Why Start With $100?

Low Barrier to Entry: Anyone can begin, even with limited funds.

Learn by Doing: Gain experience and confidence without risking large amounts.

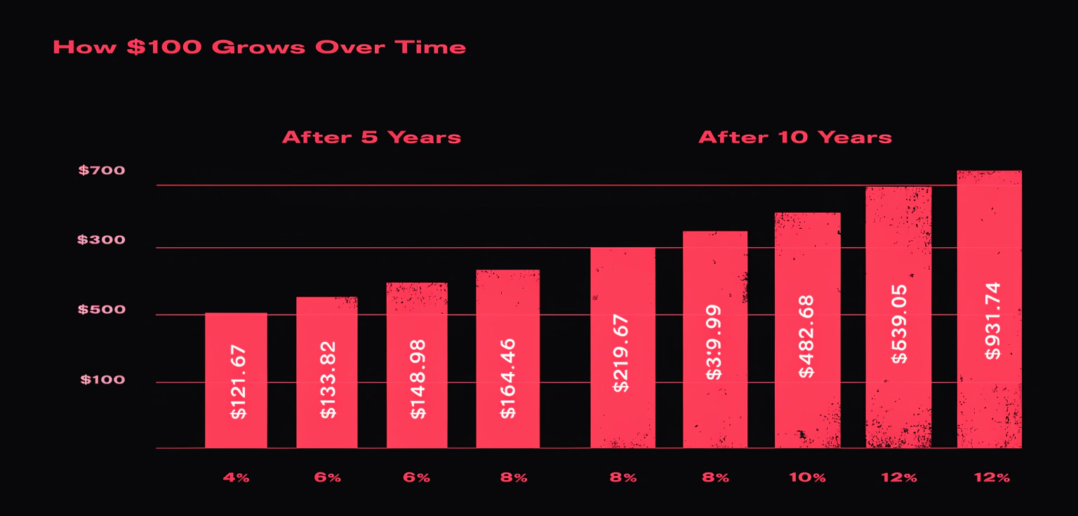

Compound Growth: Small investments grow over time through interest and returns.

Mini-Case Study:

Ahmed invested $100 monthly in a low-cost ETF. After 10 years, the portfolio grew to over $18,000 due to consistent contributions and compound growth.

Step 1 – Choose the Right Investment Platform

Brokerage Accounts: Vanguard, Fidelity, Schwab (allow fractional shares).

Investment Apps: Robinhood, Stash, Acorns (user-friendly for beginners).

Considerations: Fees, minimum deposits, and security.

Tip: Look for zero or low-fee platforms to maximize your investment.

Step 2 – Understand Investment Options for $100

Fractional Shares: Buy a portion of expensive stocks like Amazon or Tesla.

ETFs (Exchange-Traded Funds): Diversified funds with low investment minimums.

Mutual Funds: Some mutual funds allow small initial investments.

Robo-Advisors: Automated platforms that invest based on your goals and risk tolerance.

Mini-Case Study:

Sara bought $50 of a tech ETF and $50 of a bond ETF. This small diversification minimized risk and allowed exposure to both growth and stability.

Step 3 – Diversify Even With Small Amounts

Avoid putting all $100 into a single stock.

Use ETFs or fractional shares to spread risk.

Even small diversification reduces potential losses.

Example:

$50 in a technology ETF, $30 in a healthcare ETF, $20 in a bond ETF provides balanced exposure.

Step 4 – Set Up Consistent Contributions

Make investing a habit by adding $50–$100 monthly.

Automate contributions to ensure consistency.

Gradually increase investments as income grows.

Mini-Case Study:

Farhan started with $100, added $50 monthly, and after 5 years, his portfolio grew to $4,500 without extra effort.

Step 5 – Monitor and Adjust

Track your portfolio monthly or quarterly.

Rebalance investments periodically.

Avoid reacting emotionally to short-term market changes.

Common Mistakes to Avoid

Investing in only one stock

Paying high fees for small investments

Chasing hot stocks or trends

Ignoring compounding benefits

Abandoning consistency

FAQs (SEO-Optimized)

Q1: Can I really start investing with $100?

A: Yes, using fractional shares, ETFs, or robo-advisors, $100 is enough to begin investing.

Q2: Will $100 grow significantly over time?

A: Yes, consistent contributions and compounding can turn small investments into substantial wealth over years.

Q3: Is it safe to invest small amounts?

A: Diversifying across ETFs or funds reduces risk, making small investments safer for beginners.

Q4: Which investment app is best for beginners with $100?

A: Robinhood, Stash, Acorns, or Vanguard’s fractional shares platforms are beginner-friendly.

Q5: How often should I add more money to my investments?

A: Monthly contributions are ideal; consistency is key for long-term growth.

Q6: Can I withdraw my $100 if needed?

A: Yes, most platforms allow withdrawals, but consider potential market fluctuations.

Internal Links

Investing for Beginners

Zero-Based Budgeting Method

Best Budget Planner Apps 2025

External Links

Investopedia – Starting Small With Investing

NerdWallet – How to Start Investing With Little Money

Vanguard – Fractional Shares