Introduction

best budget planner apps 2025 Managing finances can be overwhelming, but the right tools can make budgeting simple and stress-free. In 2025, budget planner apps have evolved to not just track expenses but also offer savings goals, investment insights, and debt management features. This guide reviews the best apps available, explains how to choose the right one for your needs, and shares practical tips to make the most of them. Whether you’re a beginner trying to stick to a budget, a student managing limited income, or a family tracking household expenses, these apps can help you gain financial control. By the end, you’ll know which apps suit your goals and how to use them effectively for maximum savings.

Why Use Budget Planner Apps?

Automated Tracking: Syncs with bank accounts to record income and expenses automatically.

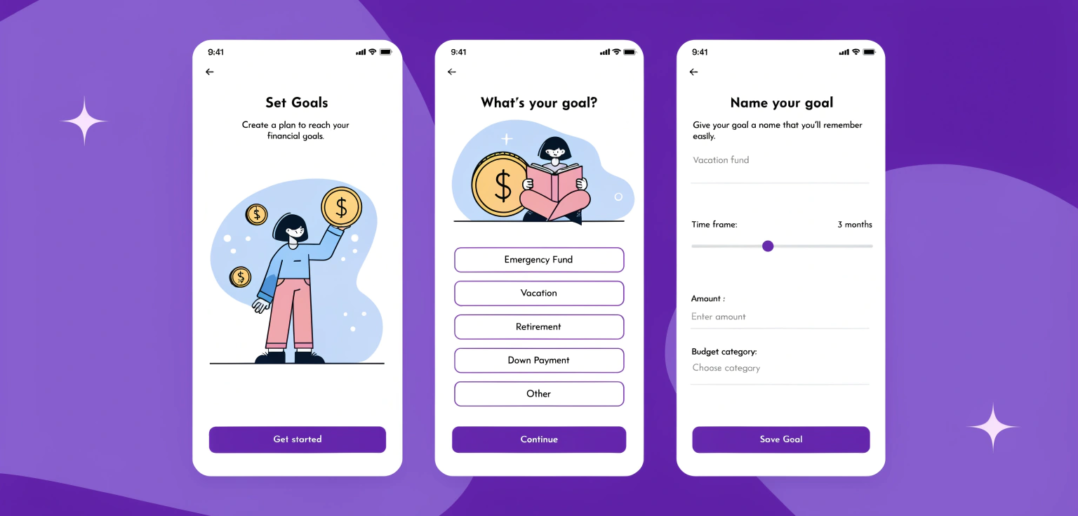

Goal Setting: Set savings goals and track progress.

Insights & Analytics: Visualize spending patterns to make informed decisions.

Mini-Case Study:

Anna, a young professional, used a budgeting app to track all subscriptions and reduced unnecessary spending by $150 per month.

Top 5 Budget Planner Apps for 2025

- YNAB (You Need a Budget

Features: Zero-based budgeting, goal tracking, bank syncing.

Pros: Encourages proactive budgeting, clear visual reports.

Tip: Allocate every dollar to a category each month.

- Mint

Features: Free budgeting, bill tracking, credit score monitoring.

Pros: User-friendly, comprehensive financial overview.

Tip: Set alerts for overspending in categories.

- PocketGuard

Features: Tracks available money after bills and savings.

Pros: Simple interface, good for beginners.

Tip: Use “In My Pocket” feature to avoid overspending.

- EveryDollar

Features: Dave Ramsey’s budgeting method, goal tracking.

Pros: Easy zero-based budgeting implementation.

Tip: Upgrade to connect bank accounts for automated updates.

- Goodbudget

Features: Envelope budgeting system, cross-device syncing.

Pros: Great for families or couples sharing a budget.

Tip: Allocate funds in virtual envelopes for each expense category.

How to Choose the Right App

Budgeting Method Compatibility: Does it support zero-based, 50/30/20, or envelope method?

Automation: Bank syncing vs manual entry.

Reports & Insights: Visuals help track spending trends.

Ease of Use: Intuitive interface reduces setup frustration.

Cost: Free vs premium features.

Mini-Case Study:

Carlos tried three apps and settled on YNAB for its zero-based budgeting focus. Within two months, he increased his monthly savings by $400.

Tips to Maximize App Effectiveness

Regularly review categories and adjust allocations.

Set realistic savings goals and track progress.

Use alerts to prevent overspending.

Sync accounts for accurate tracking.

Include debt repayment as a priority category.

FAQs (SEO-Optimized)

Q1: Which is the best free budget planner app for beginners?

A: Mint is ideal for beginners because it’s free, easy to use, and provides comprehensive expense tracking.

Q2: Are these apps secure?

A: Yes, most top apps use bank-level encryption to keep financial data safe.

Q3: Can I use multiple apps together?

A: Yes, but it’s best to choose one primary app to avoid duplicate tracking.

Q4: Do these apps work for irregular income?

A: Yes, apps like YNAB allow flexible budgeting to manage fluctuating income.

Q5: Can I share the app with family members?

A: Goodbudget and YNAB allow syncing across devices, making it easy to collaborate.

Q6: Will using a budgeting app help me save money?

A: Absolutely. By tracking expenses, identifying waste, and setting goals, most users see noticeable savings within months.

Internal Links

Budgeting for Beginners

Zero-Based Budgeting Method

How to Create a Household Budget Plan

External Links

YNAB Official Website

Mint – Budgeting Tools

PocketGuard Official Website