Introduction

A sinking fund is a simple yet powerful financial strategy that helps you save for specific, planned expenses over time. Unlike emergency funds for unexpected costs, sinking funds are designated for known future expenses like vacations, car repairs, insurance premiums, or holiday gifts. By saving small amounts consistently, you avoid financial stress and the need for loans or credit card debt. In this guide, we’ll explain what a sinking fund is, how to create one, practical tips to maximize its benefits, and real-life examples of families successfully using it. Implementing a sinking fund into your budgeting strategy ensures you’re prepared for planned expenses without disrupting your monthly budget.

What Is a Sinking Fund?

Definition: A dedicated savings account for planned, future expenses

Purpose: Smooths out large or irregular costs by spreading them over time.

Difference from Emergency Fund: Emergency funds cover unexpected costs; sinking funds are for known expenses.

Example:

If your car insurance costs $600 annually, a sinking fund allows you to save $50 monthly over 12 months instead of paying $600 at once.

Step 1 – Identify Your Sinking Fund Goals

Make a list of planned expenses: vacations, gifts, subscriptions, car maintenance.

Estimate the total cost for each goal.

Prioritize based on urgency and importance.

Mini-Case Study:

The Khan family listed 6 goals: car maintenance ($500), holiday gifts ($300), home repairs ($400). By saving $100/month across three sinking funds, they avoided last-minute financial stress.

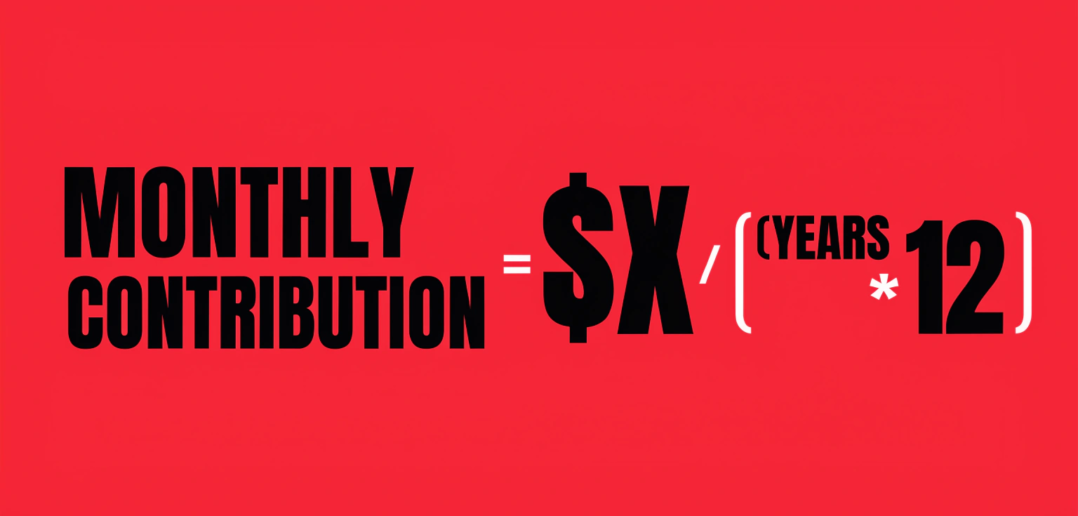

Step 2 – Determine Monthly Contribution

Formula: Monthly Contribution = Total Goal ÷ Months Until Expense

Example: $600 car insurance ÷ 12 months = $50/month contribution

Automate transfers to make saving consistent.

Step 3 – Create Separate Accounts or Track Virtually

Separate Accounts: Open individual savings accounts for major sinking fund goals.

Virtual Envelopes: Use budgeting apps like YNAB or EveryDollar to track funds digitally.

Tip: Avoid mixing sinking funds with emergency funds to maintain clarity.

Mini-Case Study:

Sara used virtual envelopes in her app to track a vacation sinking fund. She successfully saved $1,200 for a 3-week trip without touching her monthly essentials budget.

Step 4 – Fund Your Sinking Fund Regularly

Pay yourself first by allocating money monthly.

Adjust contributions if income changes or if expenses are delayed.

Use direct transfers to avoid forgetting.

Example:

If holiday gifts cost $600 and you have 6 months, set up $100/month automatic transfers.

Step 5 – Use Funds Only for Their Intended Purpose

Avoid dipping into sinking funds for other expenses.

Track remaining balance regularly.

Adjust future contributions as necessary.

Mini-Case Study:

Ali used his car maintenance sinking fund for minor repairs but avoided spending it on unrelated purchases, keeping the fund intact for future needs.

Benefits of a Sinking Fund

Prevents debt accumulation for planned expenses

Reduces financial stress

Encourages disciplined saving

Helps meet financial goals on time

FAQs (SEO-Optimized)

Q1: What is a sinking fund in simple terms?

A: A sinking fund is a dedicated savings account for planned expenses, allowing you to save gradually instead of paying a large amount all at once.

Q2: How do I start a sinking fund?

A: Identify upcoming expenses, calculate monthly contributions, and save consistently until the goal is reached.

Q3: Can I have multiple sinking funds?

A: Yes, you can create separate funds for different goals, either physically or virtually in budgeting apps.

Q4: How is it different from an emergency fund?

A: Emergency funds cover unexpected events, while sinking funds are for planned or predictable costs.

Q5: Can a sinking fund help reduce credit card debt?

A: Absolutely. By saving for planned expenses in advance, you avoid paying them with credit cards.

Q6: Should I automate my sinking fund savings?

A: Yes, automating monthly contributions ensures consistency and prevents missed payments.

Internal Links

Budgeting for Beginners

How to Create a Household Budget Plan

Zero-Based Budgeting Method

External Links

Investopedia – Sinking Fund Definition

NerdWallet – How to Plan a Sinking Fund