Introduction

The zero-based budgeting method is a powerful tool for taking complete control of your finances. Unlike traditional budgeting, where leftover money accumulates passively, zero-based budgeting assigns every dollar a specific purpose. This approach ensures that income minus expenses equals zero, giving every dollar a job, whether it’s spending, saving, or investing. In this guide, we’ll break down how to implement zero-based budgeting, share real-life examples, practical tips, and common mistakes to avoid. Whether you’re a beginner or someone struggling with money leaks, this method can help you maximize your income, reduce wasteful spending, and achieve your financial goals faster.

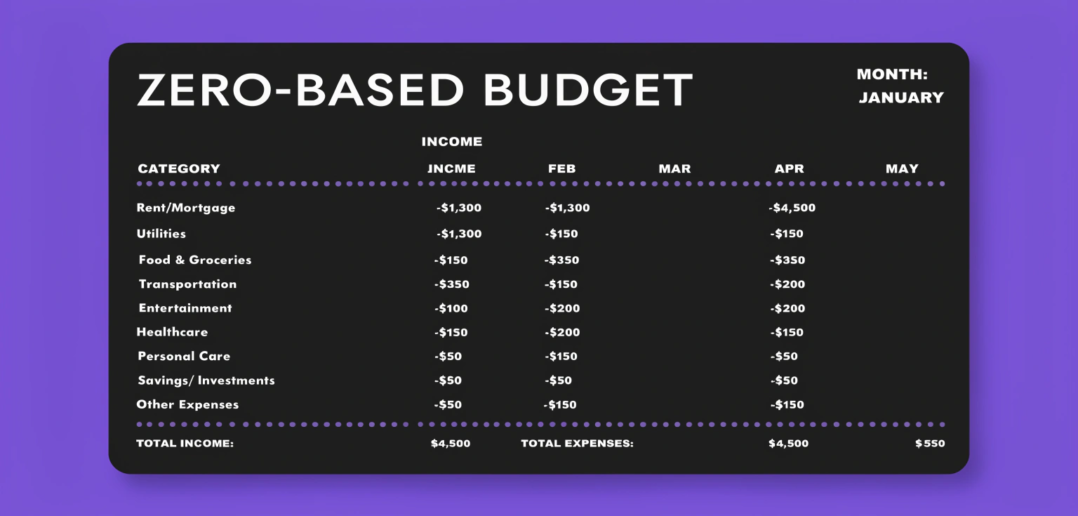

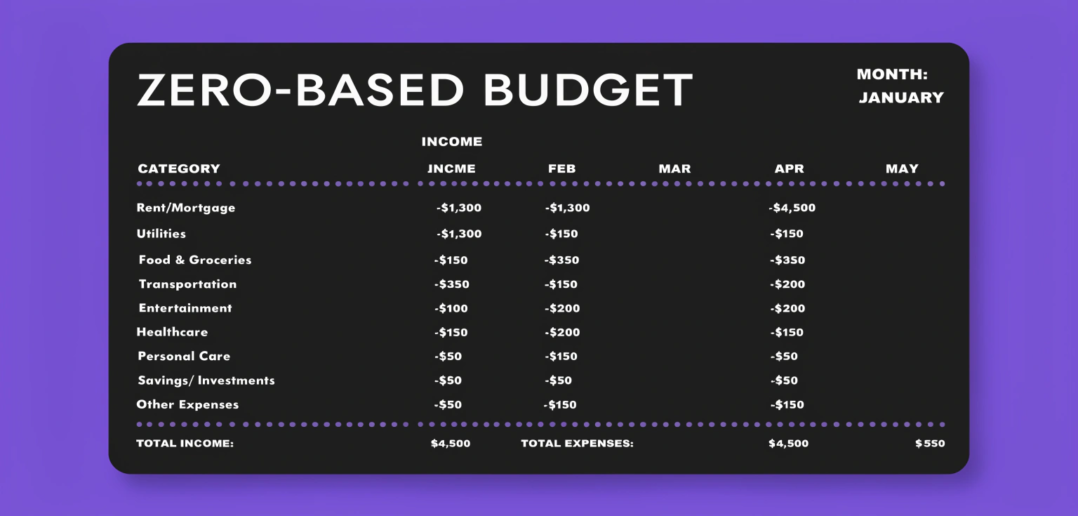

What Is Zero-Based Budgeting?

Definition: Every dollar of income is assigned to a category until your income minus expenses equals zero.

Purpose: Maximizes control over spending, increases savings, and reduces financial waste.

Example:

If your monthly income is $3,000, after assigning amounts for rent, groceries, bills, and savings, there should be no unallocated money left.

Mini-Case Study:

Maria, a freelancer, used zero-based budgeting to allocate every dollar of her irregular income. Within two months, she identified $400 of unnecessary spending and redirected it to an emergency fund.

Step 1 – Calculate Your Monthly Income

Include all sources: salary, freelance work, side hustles, and passive income.

Consider irregular or seasonal income and average it over 3–6 months.

Tip: Treat bonuses and windfalls as income to assign, not as extra spending money.

Step 2 – List Every Expense

Fixed Expenses: Rent, utilities, loan payments.

Variable Expenses: Groceries, gas, entertainment.

Periodic Expenses: Insurance, subscriptions, gifts.

Example:

Income: $3,000

Rent: $1,200

Utilities: $200

Groceries: $400

Savings: $600

Entertainment & Misc: $600

Step 3 – Assign Every Dollar a Job

Allocate every dollar to a category, leaving zero unassigned.

Include debt repayment and savings as priority categories.

Adjust allocations to cover goals and avoid overspending.

Common Mistakes:

Forgetting small recurring expenses like subscriptions or fees.

Treating leftover money as extra spending instead of assigning it.

Step 4 – Track and Adjust

Monitor spending weekly to ensure every dollar stays on track.

Adjust for unexpected expenses or income changes.

Use apps like YNAB or spreadsheets for easy tracking.

Mini-Case Study:

Alex noticed that after assigning his $2,800 monthly income, $100 was going unused. He reallocated it to a retirement savings account, accelerating his long-term goals.

Step 5 – Benefits of Zero-Based Budgeting

Financial Control: Know exactly where your money goes.

Increased Savings: Allocate funds to savings and investments systematically.

Debt Reduction: Prioritize debt repayment effectively.

Avoid Waste: Reduce impulsive or unnecessary spending.

Common Mistakes to Avoid

Ignoring irregular or seasonal expenses

Treating unassigned money as “free”

Overcomplicating categories

Not reviewing and adjusting regularly

Forgetting to include savings and debt repayment

FAQs (SEO-Optimized)

Q1: What is zero-based budgeting in simple terms?

A: It’s a budgeting method where every dollar of income is assigned to a category until nothing is left unallocated, ensuring maximum control of your money.

Q2: Is zero-based budgeting good for beginners?

A: Yes, it’s beginner-friendly and effective for tracking spending, saving, and managing irregular income.

Q3: How do I start zero-based budgeting?

A: Calculate monthly income, list all expenses, assign every dollar a purpose, track weekly, and adjust monthly.

Q4: Can zero-based budgeting work for irregular income?

A: Yes, by averaging income over several months and prioritizing essentials first.

Q5: What tools help with zero-based budgeting?

A: Apps like YNAB, EveryDollar, and Mint, or even simple spreadsheets.

Q6: How often should I update my zero-based budget?

A: Weekly tracking and monthly review are recommended to stay accurate and effective.

Internal Links

Budgeting for Beginners

How to Create a Household Budget Plan

Best Budget Planner Apps 2025

External Links

Investopedia – Zero-Based Budgeting

NerdWallet – Budgeting Strategies