Introduction

how to create a household budget plan Creating a household budget plan is one of the most effective ways to manage family finances and reduce stress. Whether you’re a single parent, newly married, or managing a large family, having a clear budget allows you to see where every dollar goes. A solid plan helps you save for future goals, cover essential expenses, and avoid financial surprises. In this guide, we’ll walk through step-by-step methods for creating a household budget plan that actually works, including real-life examples, tips for adjusting categories, and common mistakes to avoid. By the end, you’ll be empowered to take control of your household finances and ensure that your family’s financial health stays on track.

Why a Household Budget Is Essential

Control Spending: Avoid overspending on non-essential items.

Financial Security: Build emergency funds for unexpected bills.

Goal Achievement: Save for vacations, home upgrades, or children’s education.

Mini-Case Study:

The Ahmed family tracked their $5,000 monthly income and realized that $800 was going to unnecessary subscriptions. Cutting these freed up money for their child’s school savings plan.

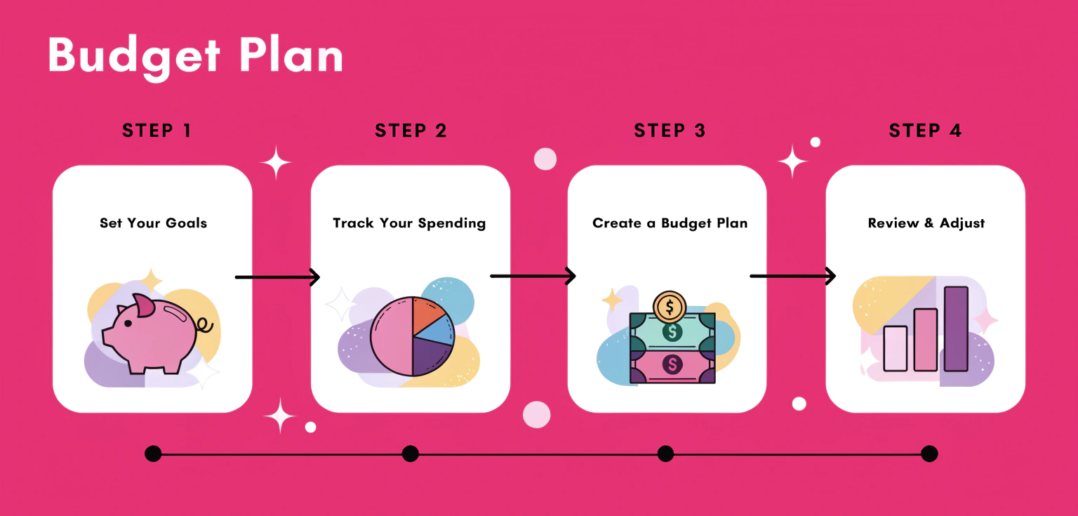

Step 1 – Track All Income Sources

Include salary, side hustles, rental income, or bonuses.

Consider irregular income and average it over a few months for accuracy.

Tools: spreadsheets, Mint, or YNAB.

Tip: Always add a buffer for irregular expenses.

Step 2 – List All Household Expenses

Fixed Expenses: Rent/mortgage, utilities, loan payments.

Variable Expenses: Groceries, gas, entertainment, and dining out.

Periodic Expenses: Insurance, medical bills, annual subscriptions.

Example:

Monthly Expenses for a household:

Rent & Utilities: $1,500

Groceries: $600

Transportation: $300

Entertainment & Dining: $400

Savings: $500

Mini-Case Study:

Leila noticed she was spending $200 monthly on coffee shops. Preparing coffee at home saved her $180 a month.

Step 3 – Categorize & Prioritize

Use the 50/30/20 rule for guidance: 50% needs, 30% wants, 20% savings.

Adjust based on your family’s lifestyle and goals.

High Priority: Housing, food, transportation, healthcare.

Medium Priority: Education, debt repayment, savings.

Low Priority: Entertainment, hobbies, luxury purchases.

Step 4 – Create the Budget Plan

Choose a Method: Spreadsheet, budgeting app, or paper planner.

Assign Funds: Allocate money to each category based on priorities.

Track Weekly: Adjust categories as needed.

Common Mistakes:

Overestimating savings, underestimating variable expenses.

Ignoring seasonal costs like holidays or birthdays.

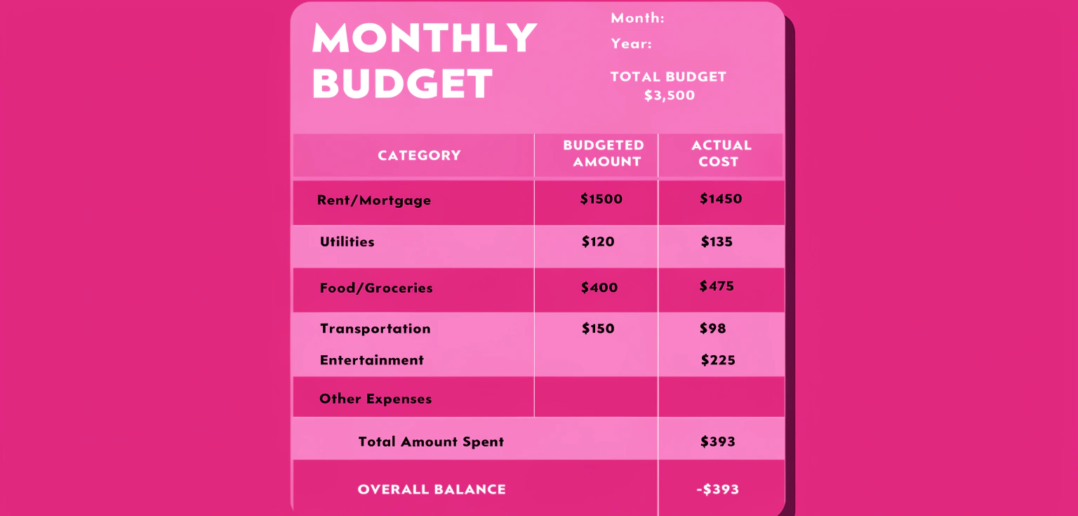

Step 5 – Monitor and Adjust Regularly

Review spending weekly or monthly.

Compare planned vs. actual expenses.

Adjust categories for lifestyle changes or unexpected costs.

Example:

When utilities rose unexpectedly by $50, the Sharma family reduced entertainment spending to maintain their savings goal.

Step 6 – Involve the Whole Family

Teach children about money management.

Encourage transparency and discussion about spending decisions.

Celebrate milestones, like reaching a savings goal, together.

Mini-Case Study:

Rina involved her teenage kids in tracking grocery expenses. They started looking for discounts and coupons, saving an additional $75 monthly.

FAQs (SEO-Optimized)

Q1: How do I start a household budget plan from scratch?

A: Begin by tracking all income and expenses for one month. Categorize spending, set priorities, and allocate money to essentials, savings, and wants.

Q2: Can a household budget work with irregular income?

A: Yes, average your income over 3–6 months and create a flexible plan, prioritizing essential expenses and savings.

Q3: How often should I review my household budget?

A: Ideally, weekly for small adjustments and monthly for overall review.

Q4: What tools are best for household budgeting?

A: Mint, YNAB, PocketGuard, or Excel spreadsheets work well for tracking family expenses.

Q5: How do I involve children in budgeting?

A: Teach them to track allowances, help with grocery lists, and discuss financial goals in an age-appropriate way.

Q6: What’s the best way to handle unexpected expenses?

A: Maintain an emergency fund and reallocate non-essential spending to cover these costs.

Internal Links

Budgeting for Beginners

Zero-Based Budgeting Method

Best Budget Planner Apps 2025

External Links

Investopedia – Household Budgeting

NerdWallet – Family Budget Tools