Introduction

Building wealth starts with effective saving strategies. In 2025, with rising expenses and financial goals becoming more ambitious, knowing how to save smartly is crucial. Many beginners struggle to save consistently due to overspending, lack of planning, or unclear goals. This guide highlights the top saving strategies that anyone can apply, regardless of income level. We’ll cover budgeting, automated saving, high-yield accounts, cutting unnecessary expenses, and smart investing for beginners. Each strategy includes practical tips, mini-case studies, and real-world examples to make implementation easy. By following these strategies, you can steadily grow your wealth, prepare for emergencies, and reach financial goals faster while building disciplined money habits for long-term financial success.

1. Pay Yourself First

Strategy: Automatically set aside a portion of income for savings before spending.

Tip: Aim for at least 20% of income each month.

Benefit: Ensures consistent saving and reduces temptation to overspend.

Mini-Case Study:

Leila set up automatic transfers of $300/month to a high-yield savings account. Within a year, she had $3,600 saved effortlessly.

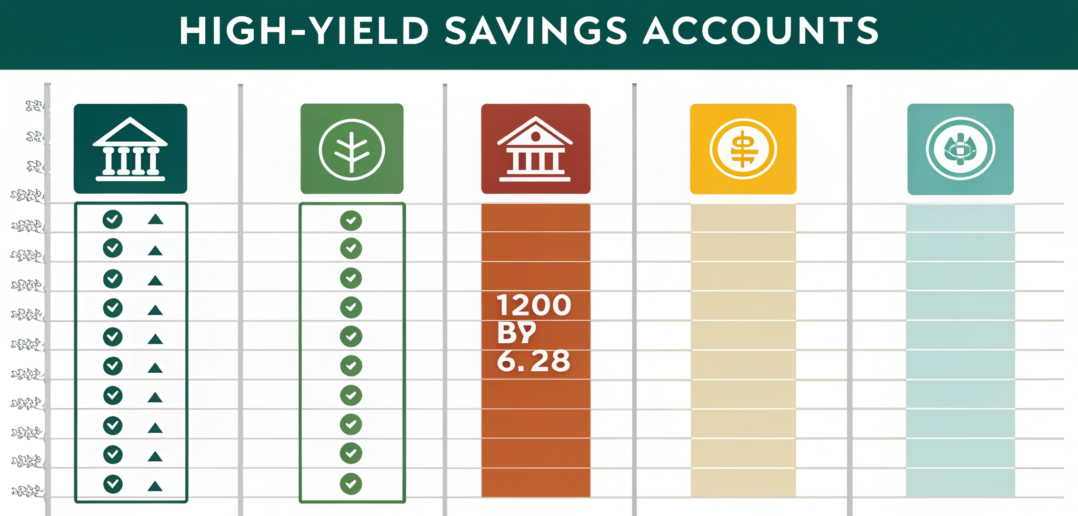

2. Use High-Yield Savings Accounts

Strategy: Keep emergency funds and short-term savings in high-interest accounts.

Tip: Compare banks for the best APY rates.

Benefit: Earns passive income on idle cash.

Example:

Hassan switched from a traditional savings account with 0.05% APY to an online account with 4.5% APY, significantly boosting his savings growth.

3. Automate Savings and Investments

Strategy: Set recurring transfers to savings, retirement accounts, and ETFs.

Tip: Start small if needed; gradually increase as income grows.

Benefit: Reduces manual effort and ensures consistency.

Mini-Case Study:

Omar automated $200/month into ETFs. After 3 years, his account balance doubled with minimal effort.

4. Reduce Unnecessary Expenses

Strategy: Track spending to identify wasteful habits.

Examples: Subscriptions you rarely use, impulse purchases, dining out too often.

Tip: Reallocate savings to high-priority goals.

Mini-Case Study:

Aisha canceled unused streaming services and redirected $50/month to her savings. Over a year, she saved $600.

5. Set Clear Financial Goals

Strategy: Define short-term, medium-term, and long-term goals.

Tip: Break large goals into monthly contributions.

Benefit: Keeps motivation high and provides measurable milestones.

Example:

Fatima planned to save $5,000 for a vacation in 12 months by saving $420/month systematically.

6. Take Advantage of Employer Benefits

Strategy: Maximize retirement contributions, matching programs, and health savings accounts.

Tip: Don’t leave free money on the table.

Benefit: Boosts wealth-building efforts without additional effort.

Mini-Case Study:

Hassan contributed 5% of his salary to his 401(k) to get full employer match, increasing his retirement savings substantially.

7. Avoid Lifestyle Inflation

Strategy: Resist increasing spending as income grows.

Tip: Allocate raises toward savings or investments.

Benefit: Accelerates wealth accumulation over time.

Example:

Omar received a $500 raise but kept expenses the same, investing the extra income monthly. After 2 years, his investment portfolio grew by $12,000.

FAQs (SEO-Optimized)

Q1: How much should I save each month in 2025?

A: Aim for at least 20% of your income, adjusting for personal goals and obligations.

Q2: What is the best way to save automatically?

A: Use bank auto-transfer features, automated investment apps, or payroll deductions.

Q3: Can small amounts grow significantly over time?

A: Yes, consistent contributions combined with compound interest lead to substantial wealth growth.

Q4: Should I focus on saving or investing first?

A: Build an emergency fund first, then focus on investing for long-term growth.

Q5: How can I avoid lifestyle inflation?

A: Keep spending habits consistent and allocate extra income toward savings or investments.

Q6: Are high-yield savings accounts safe?

A: Yes, choose FDIC-insured banks to ensure your funds are protected.

Internal Links

Personal Finance Tips for Beginners

Create a Budget That Works 2025

Zero-Based Budgeting Method

External Links

Investopedia – Saving Strategies

NerdWallet – High-Yield Savings Accounts

Forbes – Smart Ways to Save Money